Lifecycle investment

What is Lifecycle investment?

We will tailor the risk and return of the investment portfolio to the participant’s age. If the retirement date is still a long way off, then our investments will be aimed at realising a fast growth in the pension capital. As the participant approaches their retirement date, we build in more security. In this way, we reduce the risk while they still have a chance of receiving a return.

The investments are balanced to provide fixed benefits by default.

Participants opt for a fixed or variable pension benefit on their retirement date. If the participant wants a variable benefit, then they can adjust their investments accordingly by choosing Lifecycle Variable Pension.

Employer’s pension scheme

Lifecycle investment in brief

-

Every month, the employer pays a pension contribution for its employees

We deposit this contribution into the investment accounts of the employees, ‘the participants’ in the pension scheme. We, Centraal Beheer PPI, manage these investment accounts.

-

By default, we invest the contributions in a lifecycle investment portfolio.

Such a portfolio is a collection of funds. The composition of those funds is tailored to the participant’s age. The participant does not have to do anything for this.

-

Upon their retirement date, the participant purchases a pension benefit with their pension capital.

This may be a variable benefit with Centraal Beheer PPI or a fixed or variable benefit with another provider.

This is how lifecycle investment works

We divide the participant’s investments over 3 risk categories. Each category has its own objective:

First: high risk, focused on achieving a high return

We invest the pension capital mainly in mutual funds with internationally diversified shares. Shares have a higher risk, but also a higher chance of attractive returns.

Then: low risk, to ensure a little more security

As the participant approaches their retirement date, we reduce the investment risk. We will gradually exchange the higher-risk investments for lower-risk investments. We will start doing this fifteen years before the retirement date.

Finally: interest rate risk reduction

Once the participant gets another step closer to their retirement date, we also reduce the impact of changing interest rates on the amount of pension to be purchased. The amount of the pension depends heavily on the interest rate. A higher pension can be purchased if interest rates are higher on the retirement date. Therefore, if interest rates fall before the retirement date, a lower pension can be purchased.

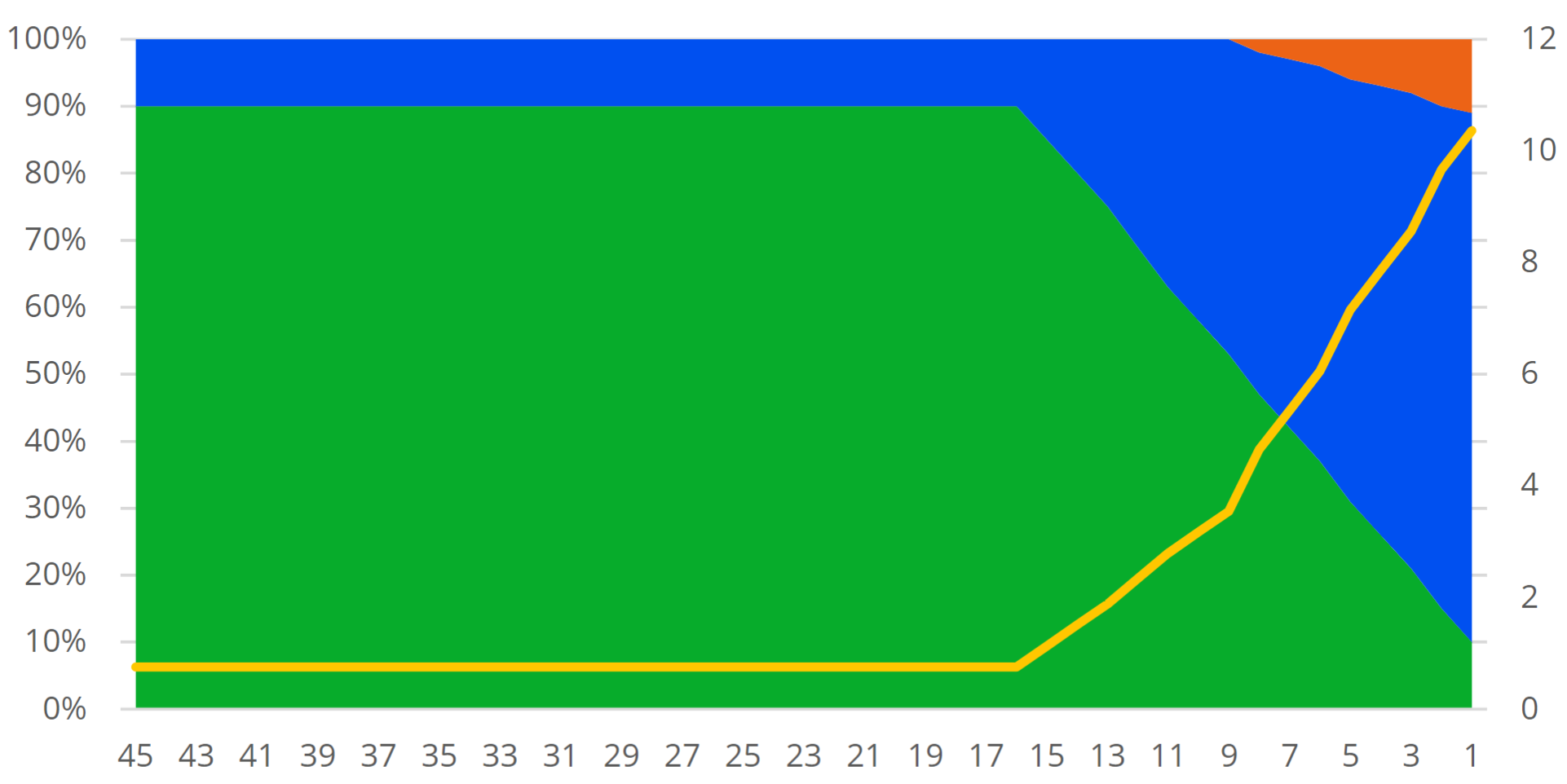

Neutral lifecycle portfolio distribution

The 3 investment profiles of Lifecycle investment

Besides the risk categories, the participants themselves choose their investment profile: neutral – aggressive – defensive. If they do not make a choice, we will invest according to the neutral investment profile by default. We rebalance the investment portfolio each year. This applies to all 3 investment profiles.

Neutral lifecycle investment

In the neutral lifecycle, the course of the investments is aligned with the risk profile of the average participant.

Defensive lifecycle investment

The investment risk is lower than the standard distribution from the neutral investment profile. So we invest the pension capital more defensively: 90% of the monthly pension contribution is then invested in high risk investments and 10% in low risk investments.

The defensive lifecycle entails:

- the risk of an approximately 5% lower pension throughout the investment period,

- but also a chance of a 3% smaller decrease in pension from age 64

- and a 1% lower decline in the last year before retirement.

Aggressive lifecycle investment

In the aggressive lifecycle, we invest the pension capital more aggressively than the standard distribution from the neutral investment profile: 95% of the monthly pension contribution is invested in high risk investments and 5% in low risk investments.

The aggressive lifecycle entails:

- the risk of an approximately 5% higher pension throughout the investment period,

- but also a chance of a 4% higher decrease in pension from age 64 and

- a 2% higher decline in the last year before retirement.

Starting fifteen years before the retirement date, we further reduce the investment risk

We will then gradually exchange the higher-risk investments for lower-risk investments. Starting eight years before the retirement date, we also reduce the interest rate risk. We then swap high-risk and low-risk investments for (long-term) bonds. From their retirement date, the participant will then invest 80% in interest rate risk reduction and 20% in low risk investments.

Relationship between return and risk

By investing more defensively than the standard distribution, the participant runs less risk with their investments. However, they will then more likely have a lower average return. If they invest more aggressively, then the investment risk will be higher. However, they will then more likely have a higher average return.

| Up to fifteen years before the retirement date | Defensive | Neutral | Aggressive |

|---|---|---|---|

| High risk | 90% | 90% | 95% |

| Low risk | 10% | 10% | 5% |

| Interest rate risk reduction | 0% | 0% | 0% |

| On the retirement date | |||

| High risk | 0% | 10% | 20% |

| Low risk | 20% | 10% | 10% |

| Interest rate risk reduction | 80% | 80% | 70% |

What do we invest in?

The lifecycle investment portfolio consists of up to 3 investment categories and up to four investment funds. The composition is tailored to the participant’s retirement date. The table below shows how the portfolios are composed:

| Portfolio | Investment Funds | Composition | ISIN code |

|---|---|---|---|

| High risk |

Investment Funds:

Achmea IM ESG Diversified Return Fund

|

Composition:

Shares in developed countriesShares in emerging markets Property shares High-yield bonds Emerging markets bonds |

ISIN code: NL0015001DJ2 |

| Low risk |

Investment Funds:

Achmea IM ESG Diversified Fixed Income Fund*

|

Composition:

Green bonds

|

ISIN code: NL0015001DH6 |

| Interest rate risk reduction |

Beleggingsfondsen:

Achmea IM ESG Diversified Fixed Income Fund*

|

Composition:

Green bonds

|

ISIN code: NL0015001DH6 |

|

Investment Funds:

Achmea IM Duration Matching Fund

|

Composition:

Euro Local Government Loans Fund 20 Year Overlay Fund |

ISIN code: NL0015001DM6 |

View the investment returns.

Lifecycle Variable Pension

We also offer the option of a Lifecycle Variable Pension fifteen years before the retirement date. This lifecycle is intended for participants who plan to opt for a variable pension benefit upon retirement. The composition of the lifecycle ends at the retirement age with the investment composition of our Variable Pension benefit. Participants can choose this lifecycle in their pension portal by going through a checklist.

Continue to invest after you have retired

Good to know

- By default, we invest in the lifecycle investment portfolio. We will tailor this to the participant’s standard retirement date. If the participant retires earlier or later, they must notify our Service Desk. We will then choose the portfolio that suits their new retirement date.

- Through their personal pension portal, the participant can always access the current value of their investments.

- In their portal, they can see how much pension capital they are expected to have accrued by their retirement date. It also gives an indication of the pension they can purchase with it.

-

The participant can find more information about this:

- In the frequently asked questions in the personal pension portal

- On the investment page in the personal pension portal

- In the pension scheme rules

The costs of lifecycle investment

The participant pays investment fees that we deduct from their pension capital. These costs consist of:

-

Fund costs

The ongoing costs incurred by investment funds for managing, keeping, registering and administrating the investment funds.

The percentages are deducted from the value invested in the fund. This is offset against the fund’s return and is therefore not separately visible. The fund costs can also be found in the pension scheme rules.

-

Management costs

These are paid annually by the participant to Centraal Beheer PPI. This is a percentage of the invested assets per year. The amount can be found in the pension scheme rules.

Low investment costs

On average, the annual fund costs are approximately 0.13% of the invested capital over the entire investment horizon. Together with the management costs, the annual investment costs total approximately 0.3% of the invested capital.

Responsible investment policy

We invest our participants’ pension capital with the aim of achieving the best possible pension. We do so in a responsible manner and with respect for people and nature. That is why our lifecycle investment portfolios consist exclusively of investment funds that meet the ESG criteria. And we take it a step further.

For more information about our investment policy click here