Investing with an eye to a sound pension

Lifecycle investment is the standard

By default, we invest the defined contribution in carefully composed lifecycle portfolios. In addition, the investments are tailored to the participants' age: is the retirement date is still a long way off? Then our investments will be aggressive. As the retirement date approaches, we will reduce the investment risk and interest rate risk. Participants are free to change their investment choice.

Review the investment optionsAsset management by Achmea Investment Management

We have outsourced asset management to Achmea Investment Management.

We select the investment funds in which we wish to invest. We compose the investment portfolios together with Achmea Investment Management, after which Achmea Investment Management will take investment decisions within the individual investment funds. They will do so in line with our investment policy.

Neutral lifecycle portfolio distribution

Strategic allocation

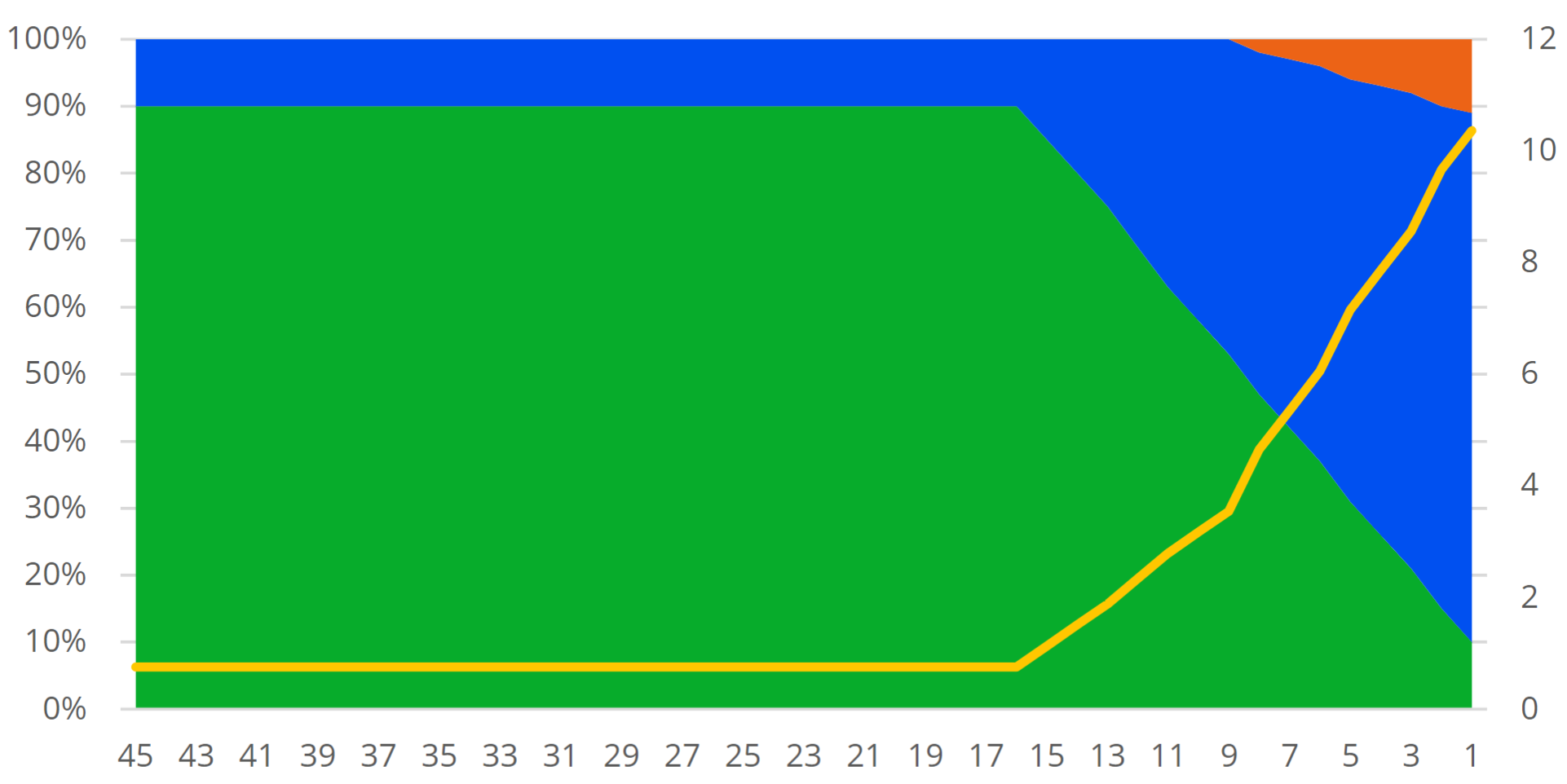

Strategic allocation refers to the distribution of pension capital across the different investment categories. We will spread the pension capital across three investment portfolios: High risk, Low risk and Interest rate risk reduction. Each of these has its own objective (see the table below).

We will change the distribution across the different portfolios as the retirement date approaches. In doing so, we will gradually reduce the risks. The strategic allocation is depicted in the graph.

Read more about the strategic allocation of lifecycles| Portfolio | Investment Funds | Composition | ISIN code | Fund costs |

|---|---|---|---|---|

|

High risk Objective: to achieve the highest possible return |

Investment Funds:

Achmea IM ESG Diversified Return Fund

|

Composition:

Shares developed countriesShares in emerging markets Property shares High-yield bonds Emerging markets bonds |

ISIN-code: NL0015001DJ2 | Fund costs: 0,16% |

|

Low risk Objective: to reduce investment risk |

Investment Funds:

Achmea IM ESG Diversified Fixed Income Fund

|

Composition:

Green bonds

|

ISIN-code: NL0015001DH6 | Fund costs: 0,10% |

|

Interest rate risk reduction Objective: to reduce investment risk and interest rate risk |

Investment Funds:

Achmea IM ESG Diversified Fixed Income Fund

|

Composition:

Green bonds

|

ISIN-code: NL0015001DH6 | Fund costs: 0,10% |

|

Investment Funds:

Achmea IM Duration Matching Fund

|

Composition:

Euro Local Government Loans Fund 20 Year Overlay Fund |

ISIN-code: NL0015001DM6 | Fund costs: 0,12% |

|

| Average fund costs across the entire investment horizon: | 0,13% | |||

Annual rebalancing

Rebalancing means that we take the actual composition of the investments and bring it back in line with the strategic allocation. This is necessary for two reasons:

- The composition of the lifecycle investment portfolio changes fifteen years before the retirement date. At that time, we will rebalance the investments to reduce the risks.

- The shift in value of each investment category varies throughout the year. As a result, the composition of the portfolio will deviate from the intended distribution over time, which will disturb the balance between risk and return.

Chance of a higher return

Factor investment

Our investment funds are composed in more or less the same way as the stock exchange (the benchmark), which means we achieve more or less the same value development. If we were to adhere closely to the index, our return would always fall short of that of the index because fund expenses are withheld from that return.

By engaging in factor investment, we try to achieve a higher return than the index. Factor investment is a technique in which businesses are selected based on such factors as their low risk, attractive valuation and positive flow. Fund managers have limited freedom to select the most appealing shares from the index.

Dividends are a type of return

In additions, fund managers make maximum use of the option to claim dividend withholding tax refunds. We reinvest those refunds for the employees. Historically, this amounts to approximately 0.30% of the invested capital on an annual basis.

View latest returnsLow costs

Our cost structure is simple and transparent. We aim to keep the fund costs as low as possible so that the participants' pensions see maximum gains from the defined contribution and the return. Because Centraal Beheer PPI offers no in-house funds, we have a pure motive to offer the best funds at the best price.

The table above lists the fund costs per investment fund. The fund costs average 0.13% per year across the entire investment horizon. In addition to the fund costs, participants must pay an annual management fee.